Introduction

The Companies Act defines Charge to mean “an interest or lien created on the property or assets of a Company or any of its undertakings or both as security and includes a mortgage”. The definition of Charge is provided as per Section 2(16) of the Companies Act. The Companies Act further requires all the companies to register any Charges created by the Company and maintain a register of it.

What are the features of the Charge?

- In Charge creation at least 2 parties must be involved, the Company on whose asset the Charge is created and the person on who holds the Charge known as “Charge holder”.

- The property on which the Charge is created may be a current or a future asset or any other property of the borrower.

- There should be an agreement and the intention of the borrower to offer one or more of its assets or properties as security for repayment of the borrowed money together with payment of interest at the agreed rate must be included in it, it may be in a written form or otherwise

Definition of Charge as per law

- Companies Act – “an interest or lien created on the property or assets of a Company or any of its undertakings or both as security and includes a mortgage”

- Transfer of Property Act – “where an immovable property of one person is by act of parties or operation of law made security for the payment of money to another and the transaction does not amount to a mortgage, the latter person is said to have a Charge on the property, and all the provisions which apply to a simple mortgage shall, so far as may be, apply to such Charge.”

Types of Charges under Companies Act, 2013

- Charges can be classified into 2 main types of Charges. These are:

- Fixed Charges- That is a Charge against a specific -identifiable property. The identity of such property will not change throughout the loan period.

- Floating Charges – That is a Charge which is not against any specifically identifiable property as such. It includes all the properties floating or uncertain such as debtors, stock-in trades, etc. In floating Charge a specific asset may not be identified.

Legal obligation to register Charges

- A Company is legally obliged to register all types of Charges whether created within or outside India. As per section 77 and Section 85 of the Companies Act, 2013, every Company creating a Charge shall register the particulars of Charge signed by the Company along with its Charge holder together with the instruments creating the Charge.

The Important points in the Act relating to Charge creation: Any Charge should be registered whether –

- created within or outside India

- on property or assets or any of the Company’s undertakings –

- Whether tangible or not situated in or outside India.

- Every Company shall keep at its registered office a register of Charges in Form No. CHG.7

which shall include therein all Charges and Floating Charges affecting any property or assets of the Company or any of its undertakings.

Register of charges

Every company shall keep at its registered office a register of charges in Form No. CHG.7 as discussed above. Following additional points should be noted with regards to the maintenance of the register of charges

- All particulars should be recorded in the register of charges, such as charges registered with the Registrar on any of the property, assets or undertaking of the company along with the particulars of the property acquired (on which charge is created). The particulars of any modification or satisfaction of charge also need to be recorded therein.

- The entries in the register of charges maintained by the company shall be made forthwith after the creation, modification or satisfaction of charge.

- Entries in the register shall be authenticated by a director or the secretary of the company or any other person authorized by the Board for the purpose.

- The register of charges shall be preserved permanently.

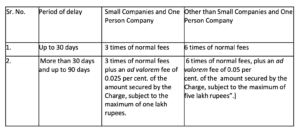

- The instrument creating a charge or modification, shall be preserved for a period of 8 yearsfrom the date of satisfaction of charge by the company.Who could inspect the register of Charge of the Company?Any member or creditor of the corporation without fees and any other individual on payment of a fee can inspect the register of Charges.Fees for delay in Charge registrationThe fees for Charge registration depend upon the share capital and size of the Company.If the Charge form is submitted with the ROC within time provided, then the normal fees as applicable to the Company shall be payable. However, if there is any delay in filing, then the following additional fees or advalorem fees as the case may be, shall be payable with effect from 1st August, 2019: –

Time period for registration of Charge

For registration of Charges, the particulars of the Charge together with a copy of the instrument, if any, creating or modifying the Charge in Form No.CHG-1 duly signed by the Company and the Charge holder shall be filed with the Registrar within a period of thirty days of the date of creation or modification of Charge along with the fee.

If the particulars of a Charge are not filed as above, such creation or modification shall be filed in Form No. CHG-1 within 120 days from the date of creation of Charge by paying additional / advalorem fees as above.

The effect of registration and non-registration of Charge

Upon registration of Charge it is considered as a deemed notice for all the stakeholders of the Company and outsiders. Further, as discussed earlier a register of Charge needs to be maintained by the Company and the register is open for inspection upon payment of prescribed fee. Hence it becomes publicly available.

The non-registration is however punishable with heavy penalty at Rupees five Lakh and for every officer in default the fine shall be Rupees fifty thousand.

Further the unregistered Charge would not be taken into account during liquidation by the liquidator. However, this does not prejudice any contract or obligation for the repayment of the money secured by a Charge.

Certificate of Registration of Charge

Post registration of Charge with the Registrar, Registrar issues a certificate of registration of Charge in Form No.CHG-2 to the Company and to the person in whose favour the Charge is created. Such certificate is the conclusive evidence that the requirements of Chapter VI of the Act (Registration of Charges) and the rules made there under are complied with.

Modification of Charge

Any modification of Charge also needs to be registered; the process is same as Charge creation. However, post registration of modification of Charge the registrar issues the certificate of registration in Form CHG-3.

Satisfaction of Charges

According to section 82 read with the Rules, the Company shall give intimation to the Registrar for satisfaction in full of any Charge, i.e. the closure of the Charge within a period of 30 days from such satisfaction in Form No.CHG-4 along with the fees.

The Registrar may, on an application by the Company or the Charge holder, allow such intimation of payment or satisfaction to be made within a period of three hundred days of such payment or satisfaction on payment of such additional fees as may be prescribed.

On receipt of such intimation, the Registrar provides a notice to the holder of the Charge calling a show cause within such time not exceeding 14 days, as to why such satisfaction in full should not be recorded. If no cause is shown, by Charge holder, the Registrar orders that a memorandum of satisfaction shall be entered in the register of Charges and the same is intimated to the Company.

When the Registrar enters a memorandum of satisfaction of Charge in full he gives a certificate of registration of satisfaction of Charge in Form No.CHG-5.

It is to be noted that the show cause notice referred above shall not be required to be sent, in case the intimation to the Registrar in this regard is in the specified form and signed by the holder of Charge.

Procedure for registration of creation/ modification satisfaction of Charge

Firstly a Company needs to pass a board resolution u/s 179 and/or special resolutions under Section 180 of the Companies Act, 2013, as the case may be, authorising its Board of directors to borrow funds. It needs to authorize its Board of directors to create Charge on the assets and properties of the Company to provide security for repayment of the borrowings in favour of the lenders. It also needs to assign any specific director/s power to sign the loan documents and carry out the requisite process.

To create/ modify according to section 77 of the Companies Act, 2013 the Company shall file particulars of the Charges along with the instrument creating / modifying Charges within 30 days from the date of creation of charge in e-Form No. CHG -1 (for other than Debentures) or Form No.CHG – 9 (for debentures /rectification), as the case may be,.

Following documents are needed to be filed with e-form No. CHG -1/ 9 A certified true copy of all instruments evidencing any creation or modification of Charge,

- Instrument(s) evidencing creation or modification, as applicable, of Charge in case of

- acquisition of property which is already subject to Charge (along with the instrument

- evidencing such acquisitions),

- In case of joint Charge and consortium finance, particulars of other Charge holders.

- Certified true copy of the resolution passed by the Board/Members

- Sanction letter if applicable

The following particulars, among other things, in respect of each Charge are required to be filed with the Registrar:

(a) date and description of the instrument creating Charge;

(b) total amount secured by the Charge;

(c) date of the resolution authorising the creation of the Charge;

(in case of issue of secured debentures only);

(d) general description of the property Charged;

(e) a copy of the deed/instrument containing the Charge duly certified or if there is no such deed, any other document evidencing the creation of the Charge to be enclosed;

(f) list of the terms and conditions of the loan; and

(g) name and address of the Charge holder. - The fees for registration of Charges need to be paid as discussed above. Electronic payments can be undertaken by credit card or by internet banking facility.

If the particulars of Charge are not filed within 30 days due to unavoidable reasons, then additional fees need to be paid as above. - An application for delay to the registrar shall be filed in Form No.CHG-10 and supported by a declaration from -10. The same needs to be signed by its secretary or director that “such belated filing shall not adversely affect rights of any other intervening creditors of the Company.”

- Verification of such instruments is required to be made, evidencing any creation (or modification of Charge), where the instrument or deed is for any property situated outside India. The copy is to be verified by a certificate issued either under the seal of the Company, or under the hand of any director. The Company secretary of the Company or an authorised officer of the Charge holder or under the hand of some person other than the Company who is interested in the mortgage or Charge can also sign the same.

- Where the property is partly situated in India, verification of every instrument evidencing any creation is also necessary.

- The e-form required to be submitted with the ROC is required to be digitally signed by the Director/Secretary of the Company, the Charge holder and e-form needs to be certified by a practising professional like CS, CA or CMA.

Upon registration of the Charge the registrar will issue a certificate of registration of such Charge in the Form No.CHG-2. Where the particulars of modification of Charge is issued in the Form No. CHG-3. - When the Charge is satisfied, the Company within a period of 30 days from the date of the payment or satisfaction in full of any Charge shall intimate to the registrar in Form No.CHG-4 along with the fees prescribed

When the Registrar enters a memorandum of satisfaction of Charge in full Form No.CHG-5 is issued. - For changes in relation to creation, modification and satisfaction of Charge, entry in the register of Charges maintained by the Company in Form No. CHG.7 is required to be made.

The entries in the register shall be authenticated by a director or the secretary of the Company or any other person authorised by the Board.

Registration Arena is the expert hub that can assist you with the Registration of Charges and various other services required for the smooth running of your business. For more details call us at 8600544411 / 8600544422.